ATL Rising: Turbulence, Trajectories, and Tells in the Airline Market

There are cities that hum, and then there’s Atlanta—a civic engine where aviation doesn’t merely operate, it reigns. Hartsfield-Jackson International, that protean hive of jet fuel and logistics, offers more than connections; it offers clues. On May 30, 2025, the airport’s pulse—captured through a brief but revealing dataset—gives investors something more precious than certainty: signal in the noise.

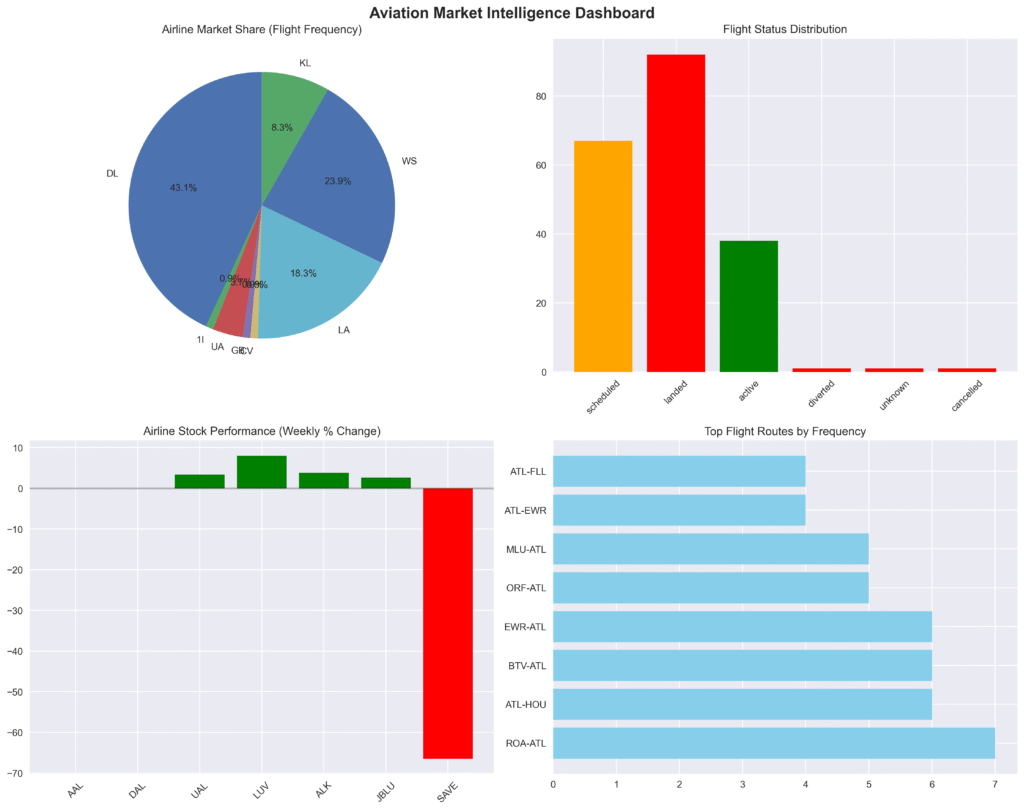

Begin with the crown jewel: Delta Air Lines (DAL). At $48.50, unmoved on the day, Delta lounges atop a 47% market share at ATL like a monarch unchallenged. That flatline might fool the casual observer into dismissiveness, but the deeper investor knows this is a classic case of status quo bias—we trust what’s familiar. With a near-monopoly at the busiest airport in the world, Delta represents a foundational hold in any aviation-heavy portfolio. It’s the backbone, the ballast.

But then there’s Southwest Airlines (LUV), showing off an 8% gain to $33.71—a clear sign of both recency bias and real momentum. Operational improvements and expanding market share at ATL make LUV a compelling buy. The numbers don’t lie: high frequency on key domestic routes and efficiency metrics suggest real strategic growth. United (UAL) follows with a 3.4% lift, reaching $78.57—another buy for investors seeking stability with upside, especially as UAL grows its ATL presence despite Delta’s dominance.

Alaska (ALK) at $52.03 (+3.8%) and JetBlue (JBLU) at $5.06 (+2.6%) both warrant cautious optimism. They signal recovery and tactical positioning rather than breakout potential—ideal for investors applying the diversification heuristic to reduce volatility across sectors.

Then there’s the cautionary tale: Spirit (SAVE), nose-diving 66.5% to a perilous $1.08. Here, loss aversion comes into full view. Many investors will be tempted by the “discount,” but heed the fundamentals: such a drop rarely signals a temporary glitch. Spirit may face restructuring, consolidation, or worse. For now, it’s a do not touch—unless you thrive on distressed assets and iron-stomached speculation.

Operationally, ATL shows promise: more “landed” than “scheduled” flights, low cancellations, and strong domestic demand. That’s not just throughput—it’s resilience. Paired with falling fuel costs (-2.1%) and steady employment, the macro winds blow favorably for aviation.

Investor Takeaway:

- Strong Buy: LUV, UAL

- Hold: DAL, ALK

- Speculative Buy: JBLU

- Avoid: SAVE

In aviation—as in investing—it pays to look beyond the tarmac. The skies above Atlanta may well be charting the next leg of the market’s flight path.

DISCLAIMER: This report is intended for informational and educational purposes only and should not be considered financial advice. Always do your own research and consult a licensed financial advisor before making investment decisions. Machine learning models are tools, not guarantees. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal.

Leave a Reply

You must be logged in to post a comment.