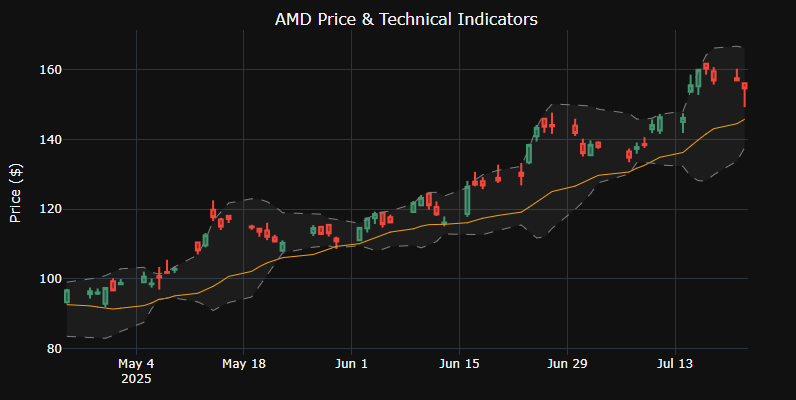

The semiconductor giant has been riding high on AI momentum, but recent signals suggest caution may be warranted. AMD stock has surged an impressive 16% over the past month, dramatically outpacing major technology peers like Apple, Microsoft, and Google. With artificial intelligence infrastructure driving unprecedented demand for advanced chips, the question for investors becomes: Is this rally sustainable, or are we approaching a dangerous inflection point?

For growth-focused portfolios seeking exposure to the AI revolution, AMD represents both compelling opportunity and significant risk that demands careful consideration.

Key Growth Drivers

- AI Infrastructure Leadership: AMD’s MI300X accelerators are gaining serious traction in data centers, positioning the company as a credible challenger to NVIDIA’s dominance in the lucrative AI chip market

- Diversified Revenue Streams: Strong performance across multiple segments including data center processors, gaming graphics cards, and PC processors provides stability and multiple growth vectors

- Institutional Confidence: With 68% institutional ownership from major firms like Vanguard and BlackRock, AMD enjoys strong backing from sophisticated investors who see long-term value

- Market Share Expansion: The company continues to gain ground against Intel in both server and consumer markets, benefiting from superior chip architecture and manufacturing partnerships

Risk Factors

- AI Bubble Concerns: Industry warnings about an “AI bubble worse than the 1999 dot-com crash” could trigger broad-based selling in AI-related stocks, regardless of individual company fundamentals

- High Market Correlation: AMD’s strong correlation with broader technology markets means any sector-wide pullback could disproportionately impact the stock

- Intense Competition: Persistent pressure from Intel’s new chip architectures and NVIDIA’s continued AI dominance creates ongoing market share battles

- Valuation Vulnerability: Recent momentum may have pushed the stock ahead of near-term fundamentals, making it susceptible to profit-taking and technical corrections

Historical Examples of Strong Growth

Companies like NVIDIA demonstrated how semiconductor leaders can deliver extraordinary returns during technology transitions. NVIDIA’s transformation from a gaming-focused graphics company to an AI infrastructure powerhouse shows how chip companies with the right technology can capture massive market shifts.

Similarly, Intel’s dominance during the PC revolution in the 1990s and early 2000s illustrates how positioning in critical computing platforms can drive sustained growth. AMD’s current AI and data center positioning suggests similar potential, though execution and market timing remain crucial factors.

The Verdict

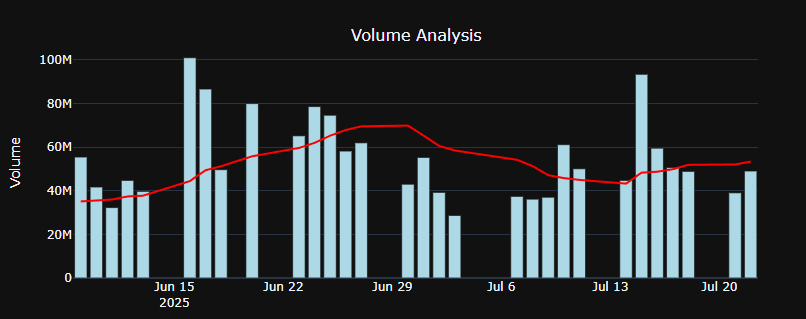

AMD presents a classic high-risk, high-reward investment profile. The company’s strong competitive position in AI infrastructure and impressive recent outperformance demonstrate genuine growth potential. However, concerning technical signals, AI bubble warnings, and the stock’s high sensitivity to broader market movements suggest significant caution is warranted.

The mixed signals – from strong institutional backing and positive sector trends to bearish short-term momentum and valuation concerns – create a challenging investment decision. Current market conditions appear to favor a wait-and-see approach, allowing for clearer directional signals to emerge.

For investors with higher risk tolerance, any position should be carefully sized and prepared for substantial volatility. Success will likely depend on continued AI adoption acceleration, AMD’s ability to gain meaningful market share from competitors, and avoiding broader technology sector corrections.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Stock investments carry inherent risks, including potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. Consider exploring diversified investment strategies and professional portfolio management to help navigate