PLTR Stock Analysis: July 14, 2025

Disclaimer

The following analysis is for informational purposes only and does not constitute financial advice. This assessment involves significant risk and represents solely the opinion of the Axon Synergy Staff with aid from AI-driven analytical tools. Readers are strongly advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Past performance does not guarantee future results, and all investments carry the risk of substantial loss.

1. Technical Analysis Interpretation

Palantir Technologies (PLTR) presents a mixed technical picture based on current indicator values. The On-Balance Volume (OBV) reading of 0.078 suggests moderate accumulation, while the close-to-open ratio of 0.072 indicates slight positive price momentum within trading sessions. The high-to-low ratio of 0.065 reflects contained intraday volatility, though the overall annualized volatility remains elevated at 78.8%.

Key momentum indicators show conflicting signals. The Stochastic K (0.061) and Stochastic D (0.051) values suggest the stock is positioned in neutral territory, neither overbought nor oversold. The RSI reading of 0.048 reinforces this neutral stance, sitting just below the midpoint threshold. The distance to support metric of 0.045 indicates the stock is trading relatively close to identified support levels.

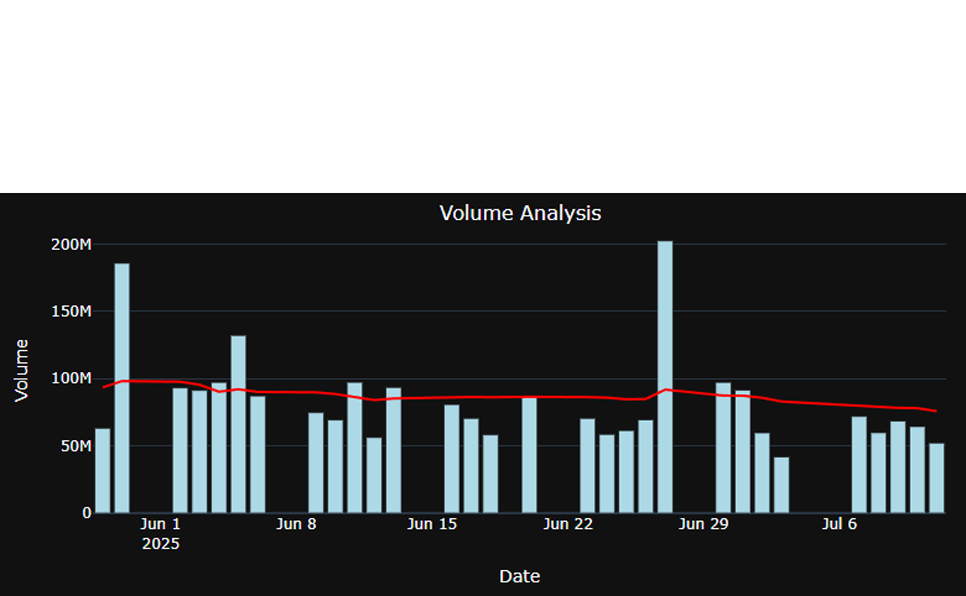

Volume trends, as reflected in the technical drivers, suggest moderate but not overwhelming institutional participation. The price change factor of 0.049 indicates recent upward momentum, though this must be viewed in context of the stock’s high volatility profile.

Overall Technical Picture: Mixed to neutral, with slight bullish undertones tempered by high volatility and proximity to support levels.

2. Multi-Source Sentiment Analysis

News Sentiment: The company news analysis reveals a notably positive outlook, with a sentiment score of 0.57 based on 20 articles analyzed. The “Very Positive” classification suggests favorable coverage, though the overall impact score of 0.28 indicates this positivity may not be translating into significant market momentum.

Reddit Sentiment: Retail investor sentiment presents a stark contrast, with a negative score of -0.10 and a bullish ratio of only 42.9%. Despite analyzing 13,841 comments across 11 posts, the sentiment remains bearish. Notably, Wall Street Bets activity is minimal at just 7 mentions, and no unusual activity flags were detected, suggesting subdued retail interest rather than coordinated movement.

Insider Trading: The insider activity analysis reveals concerning bearish signals, with net insider selling of 1,415,644 shares across 22 transactions. Significant sales include a 405,000-share transaction by SANKAR SHYAM on June 10, 2025, and multiple executive-level dispositions. This substantial net selling activity provides a clear bearish directional signal from those with privileged company information.

Synthesis: The sentiment analysis reveals a significant divergence between institutional/media positivity and both retail pessimism and insider selling activity. This disconnect suggests potential market inefficiencies but also raises questions about the sustainability of any positive momentum given the overwhelming insider selling pressure.

3. ML Model Prediction Evaluation

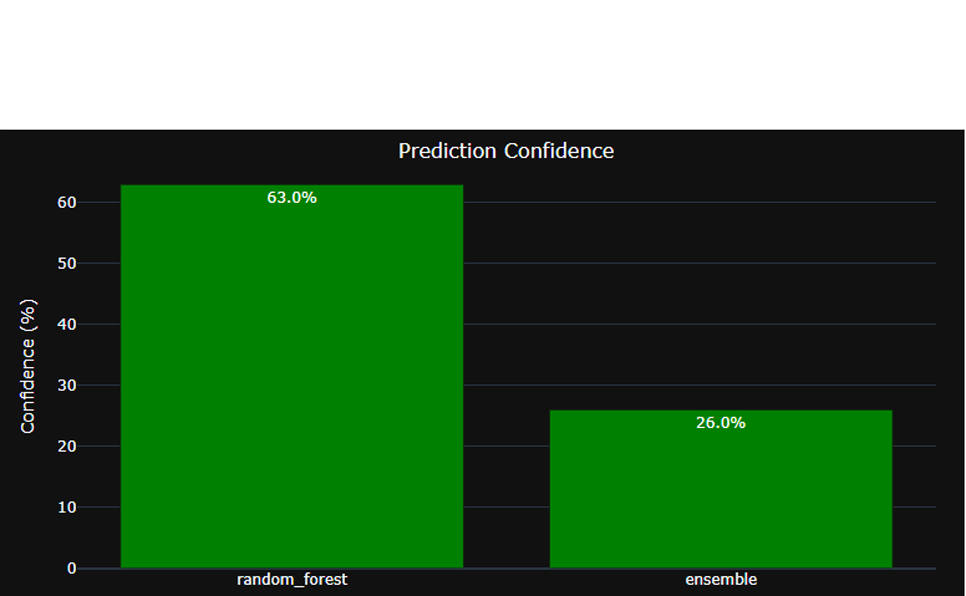

The machine learning analysis presents bullish predictions with notably different confidence levels. The Random Forest model indicates a 63.0% probability of price increase with a confidence level of 63.0%, suggesting moderate conviction in the upward direction. The Ensemble model, while also predicting bullish movement with a 63.0% probability of increase, shows significantly lower confidence at just 26.0%.

This divergence in confidence levels is particularly noteworthy. While both models agree on direction, the substantial difference in confidence suggests underlying uncertainty in the predictive signals. The ensemble model’s low confidence of 26.0% indicates the combined algorithms are detecting conflicting patterns that reduce overall conviction.

The probabilistic nature of these predictions must be emphasized – a 63.0% probability of increase still implies a 37.0% chance of decline. Given the ensemble model’s low confidence, investors should treat these predictions as suggestive rather than definitive, particularly when considered alongside the concerning insider selling activity.

4. Market Positioning and Peer Comparison

PLTR maintains institutional ownership of 55.9%, representing moderate institutional confidence. This level suggests meaningful institutional participation without being heavily concentrated. The top institutional holders include Vanguard Group Inc. (198.5 million shares, $29.2 billion), BlackRock Inc. (188.2 million shares, $27.7 billion), and State Street Corporation (88.4 million shares, $13.0 billion).

The stock demonstrates strong relative performance versus its Technology sector peers, outperforming by +11.09%. Specific peer comparisons show PLTR’s superior recent performance: +12.12% relative to Apple (+0.51%), +10.50% relative to Microsoft (+2.12%), +9.91% relative to Google (+2.71%), and +11.83% relative to Meta (+0.80%).

Market correlation analysis reveals PLTR’s strong ties to broader indices: 0.720 correlation with QQQ (NASDAQ), 0.663 with SPY (S&P 500), and 0.583 with DIA (Dow Jones). The -0.642 correlation with VIX suggests the stock tends to move inversely to market fear, typical of growth-oriented technology stocks.

The 55.9% institutional ownership level indicates moderate institutional confidence while leaving room for increased participation, potentially supporting upward pressure if sentiment improves.

5. Risk Assessment and Position Sizing Recommendations

The risk analysis reveals significant volatility concerns with a Value at Risk (VaR) of 10.05% at 95% confidence, indicating potential daily losses exceeding 10% in extreme market conditions. The Sharpe ratio of 0.79 suggests reasonable risk-adjusted returns, though this must be considered against the high annualized volatility of 78.8%.

The Kelly Criterion recommends a position size of 4.8%, reflecting the high-risk, high-reward nature of the investment. This relatively modest allocation accounts for the substantial volatility and uncertainty inherent in the stock.

Recommended hedging strategies include protective puts positioned 5-10% out of the money, with an estimated cost of 1-3% of position value but high effectiveness in downside protection. Given the elevated risk metrics, conservative position sizing becomes critical for portfolio preservation.

The combination of high volatility, significant insider selling, and modest ML confidence levels necessitates robust risk management protocols and conservative capital allocation for most investor profiles.

6. Contrarian Signals or Crowded Trade Warnings

Several significant divergences suggest potential contrarian opportunities while also flagging crowded trade risks. The most notable contrast exists between positive news sentiment (0.57) and negative retail sentiment (-0.10), indicating a disconnect between institutional/media optimism and retail investor pessimism.

The moderate institutional ownership of 55.9% suggests the position is neither extremely crowded nor completely ignored by institutions. However, the overwhelming insider selling activity of 1.4 million net shares sold represents a significant red flag that contradicts both positive news sentiment and bullish ML predictions.

This combination suggests a potentially crowded long position among retail algorithmic traders and momentum followers, while insiders and sophisticated participants may be positioning more defensively. The low WSB activity and minimal unusual retail activity patterns suggest this isn’t driven by retail mania, making the insider selling even more concerning.

These signals indicate heightened volatility potential and suggest any bullish momentum could face significant headwinds from continued insider distribution.

7. Key Catalysts and Upcoming Events to Watch

Based on the technology sector positioning and current market dynamics, several critical events warrant monitoring. Quarterly earnings announcements will be particularly significant given the divergent sentiment signals and recent insider activity patterns. Any guidance revisions or commentary addressing the substantial insider selling could materially impact sentiment.

Government contract announcements remain crucial catalysts for Palantir, given its significant government exposure. Defense spending decisions, cybersecurity initiatives, and data analytics contract awards could provide significant positive catalysts. Conversely, any regulatory changes affecting government contractors or data privacy requirements could create headwinds.

Technological developments in artificial intelligence and machine learning capabilities could serve as positive catalysts, particularly given the current positive news sentiment. However, competitive positioning announcements from major technology companies could create pressure.

Institutional sentiment shifts, as reflected in 13F filings and analyst upgrades/downgrades, will be critical to monitor given the current 55.9% institutional ownership level and the potential for sentiment momentum changes.

8. Actionable Trading Strategy with Specific Levels

Given the conflicting signals and high volatility profile, a cautious, defensive approach is recommended across multiple timeframes.

Short-Term Strategy (1-7 days): Recommend a wait-and-see approach given the 26.0% ensemble confidence and significant insider selling. For aggressive traders, any entry should be positioned with tight stop-losses at 8-10% below entry points. The high daily VaR of 10.05% suggests position sizes should be reduced by 50% from normal allocations.

Medium-Term Strategy (1-3 months): A defensive scaling approach is advised. If technical support levels around current ranges hold and insider selling subsides, gradual accumulation could be considered, but only with position sizes aligned to the 4.8% Kelly Criterion recommendation. Any positions should incorporate protective puts as outlined in the hedging strategy.

Given the uncertainty reflected in the low ensemble confidence and concerning insider activity, a “wait-and-see” approach is most prudent until clearer directional signals emerge. The divergent sentiment signals and high volatility make establishing clear entry/exit levels particularly challenging in the current environment.

Stop-Loss Recommendations: Conservative stop-losses at 15% below entry, moderate at 12%, and aggressive at 8%, with trailing stops implemented once positions move favorably by 10% or more.

Overall Summary

PLTR presents a complex investment proposition with a “Cautious Neutral to Bearish” outlook for both short-term (1-7 days) and medium-term (1-3 months) horizons. While positive news sentiment and relative sector outperformance provide some support, the combination of overwhelming insider selling (-1.4 million shares), low ML ensemble confidence (26.0%), and high volatility (78.8%) creates significant uncertainty.

Key uncertainties include the sustainability of positive momentum given massive insider distribution, the reliability of ML predictions with low confidence levels, and the potential for sentiment reversal if insider selling continues. Critical monitoring factors include quarterly earnings results, government contract announcements, and any explanations for the substantial insider selling activity.

The divergent signals between institutional optimism and insider bearishness, combined with elevated risk metrics, reinforce the need for a highly cautious approach and conservative position sizing. Investors should prioritize capital preservation and robust risk management protocols given the current signal uncertainty. The strong institutional presence and effective business coaching in corporate communication skills suggest management maintains confidence in long-term performance metrics, though near-term execution and leadership presence during upcoming presentations will be critical for sustaining investor confidence in this high-volatility environment.

EXECUTIVE SUMMARY:

Primary Signal: 📈 BULLISH (26.0% confidence)

Risk Level: High

Sharpe Ratio: 0.79

Suggested Position Size: 4.8%

MACHINE LEARNING PREDICTIONS:

RANDOM FOREST:

• Direction: 📈 BULLISH

• Probability of Increase: 63.0%

• Confidence Level: 63.0%

ENSEMBLE:

• Direction: 📈 BULLISH

• Probability of Increase: 63.0%

• Confidence Level: 26.0%

SENTIMENT ANALYSIS:

📰 News Sentiment:

• Company News: Very Positive (Score: 0.57)

• Articles Analyzed: 20

• Overall Impact: 0.28

🔥 Reddit Sentiment:

• Score: -0.10

• Bullish Ratio: 50.0%

• WSB Activity: 5 mentions

• Unusual Activity: ✅ NO

• Total Posts/Comments: 9/13830

INSIDER TRADING ACTIVITY:

—————————————-

Net Shares: -1,415,644 (Bearish)

Recent Transactions: 10

Total Analyzed: 22

MARKET POSITIONING & ANALYSIS:

—————————————-

Institutional Ownership: 55.9%

Performance vs Sector: +11.09%

Target Performance: +12.63%

📊 Market Correlations:

• SPY (S&P 500): 0.663

• QQQ (NASDAQ): 0.720

• DIA (Dow Jones): 0.583

• VIX (Volatility): -0.642📈 Sector Peer Comparison:

• AAPL: +0.51% (Relative: +12.12%)

• MSFT: +2.12% (Relative: +10.50%)

• GOOGL: +2.71% (Relative: +9.91%)

• META: +0.80% (Relative: +11.83%)RISK ANALYSIS:

Value at Risk (95% confidence): 10.05% daily

Sharpe Ratio: 0.79

Volatility: 78.8% annualized

Kelly Criterion Position Size: 4.8%

Recommended Hedging Strategies:

• Protective Puts: Buy put options 5-10% out of the money